You may need to enable the Solver Add-In by going to FileOptionsAdd-InsManage. Its equal to the effective return the actual return minus the risk-free rate of an investment divided by its standard deviation the latter being a.

In this worksheet a portfolio of 7 assets are optimized using Markowitz theory.

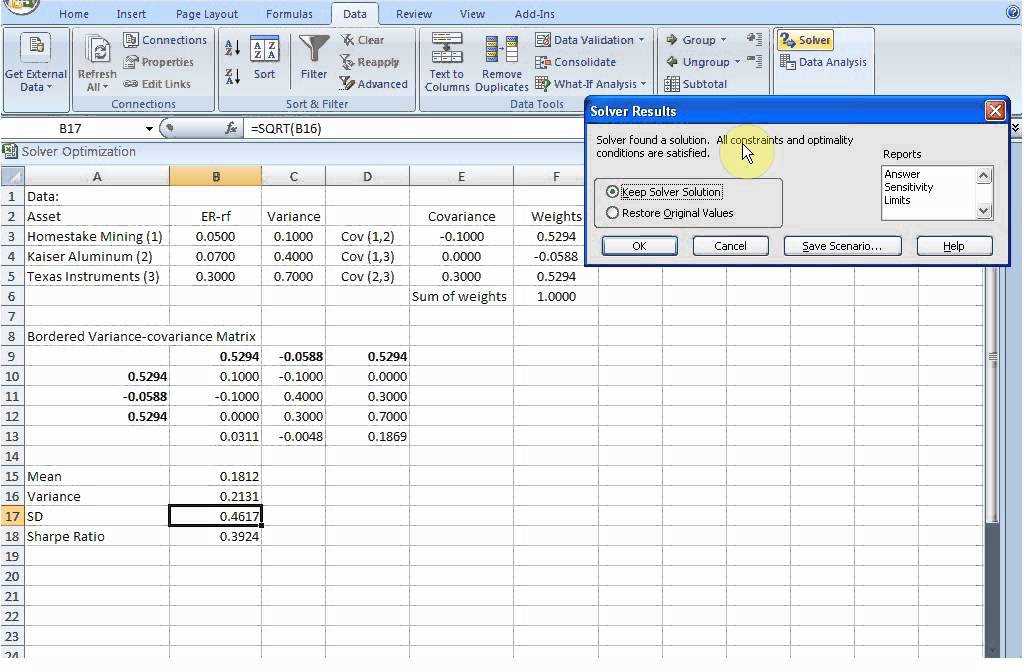

Optimal risky portfolio excel solver. This is an instuction video on how to use Excels solver for calculating efficient portfolios. PortfolioanalysisOptimizing a portfolio of multiple assets in Excel using Solver. Fixed Income Portfolio Optimization using EXCEL Solver For a given portfolio of bonds the general challenge is optimizing the duration yield trade off.

This can be handled by creating a unit of yield for a unit of duration divide YTM by duration score for each bond. Duration or interest rate sensitivity serves as a proxy for risk. The spreadsheet uses the Excel Solver to find the portfolio that maximizes the Sharpe Ratio.

You may need to enable the Solver Add-In by going to FileOptionsAdd-InsManage. The Sharpe Ratio quantifies the risk efficiency of an investment. Its equal to the effective return the actual return minus the risk-free rate of an investment divided by its standard deviation the latter being a.

Using Excels Solver Tool in Portfolio Theory Excel contains a tool called the Asolver that lets you maximize or minimize functions subject to general constraints. We will use this tool to compute the global minimum variance portfolio and the tangency portfolio for the three-firm example see the spreadsheet 3firmxls. The spreadsheet for this tutorial is called solverexxls.

The data for. The optimal portfolio calculation also becomes more complicated with the addition of more variables. In this worksheet a portfolio of 7 assets are optimized using Markowitz theory.

The complex formulas are calculated using Matrix equations and the optimal portfolio is determined using the Solver in Microsoft Excel. With this worksheet you will be able to customize a portfolio. To model this in Excel we first find the tangent portfolio by maximizing the sharpe ratio subject to the constraint of all portfolio weights adding up to 100 using Excels solver.

We then construct a risky-riskless portfolio by combining the tangent portfolio with the risk-free asset in at an arbitrary weight. We find the mean and standard deviation of the portfolio at this arbitrary weight. Since the standard deviation of the risk-free asset.

An optimal portfolio – the portfolio which will provide the maximum return for the lowest unit of risk – is then estimated by maximizing the Sharpe ratio. A minimum variance portfolio and with the Pro-edition the portfolio which maximizes the geometric mean portfolio return are also produced. In this note we show how it can be used to find portfolios that minimize risk subject to certain constraints.

How to do optimal portfolios with short sales constraints using Excels solver. This video shows you how to calculate optimal portfolios with constrains using Excels solver. We will start with a worksheet that models the Risk Reward Trade Off Line followed by by a worksheet that models Portfolio Optimization of 2 Assets.

With these two worksheets as a basis we will use the Microsoft Excel Solver to model the complex Portfolio Optimization of more than 2 assets. Finally we will integrate our portfolio optimization model with stock prices downloaded from. An investor wants to put together a portfolio drawing from a set of 5 candidate stocks.

What is the best combination of stocks to achieve a given rate of return with the least risk. This is a video created by Dr. Colby Wright demonstrating how to use the matrix algebra and solver functions in Excel in order to optimize the weights within.

At this point we have everything we need to do an initial run of Solver to find out the optimal portfolio using the current universe of securities. Given our current set of metrics we can either maximize return or minimize risk. Alternatively we can pick one for the objective function and restrict the other using a model constraint.

Another variation is to calculate a single ratio such as return per unit of risk and. To see it work you have to open the file in Excel and enable Solver. The workbooks are the same except the 2010 version consumes less file space.

They contain four sheets. Instructions Inputs Calculations Results. I suggest you read Instructions first.

I made up the covariances in these workbooks for the purpose of demonstrating how to use Solver to find risk parity weights. By contrast this book does nearly everything in plain vanilla Excel1 1 I have made two exceptions. The Constrained Portfolio Optimization spreadsheet uses a macro to repeatedly call Solver to map out the Constrained Risky Opportunity Set and the Constrained Complete Opportunity Set.

The Trader and Dealer Simulations use macros to. Solvers or optimizers are software tools that help users determine the best way to allocate scarce resources. Examples include allocating money to investments or locating new warehouse facilities or scheduling hospital operating rooms.

In each case multiple decisions need to be made in the best possible way while simultaneously satisfying a number of requirements or constraints. The best or optimal solution might mean maximizing profits minimizing costs or achieving the best.