Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations Guidelines for. Brief on the National Risk Assessment NRA in the United Arab Emirates Government of the UAE May 2018 italics added.

Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible.

Is risk based financing illegal. Risk-based pricing occurs when lenders offer different consumers different interest rates or other loan terms based on the estimated risk that the consumers will fail to pay back their loans. Skip to main content An official website of the United States government Español 中文 Tiếng Việt 한국어 Tagalog Pусский العربية Kreyòl Ayisyen 855 411-2372. Submit a Complaint.

Rather than waiting until illegal transactions and transfers have already taken place an RBA allows you to implement stop gaps. These measures ensure nothing problematic has taken place or minimize the amount thats already happened. Financial institutions must adhere to governmental regulations to prevent money laundering.

And risk-based approaches better enable them to protect themselves. Banks face medium risk to illegal financing. The Bangko Sentral ng Pilipinas BSP said its latest assessment showed that the banking sector has a medium risk exposure to money laundering terrorist financing and proliferation financing MLTFPF.

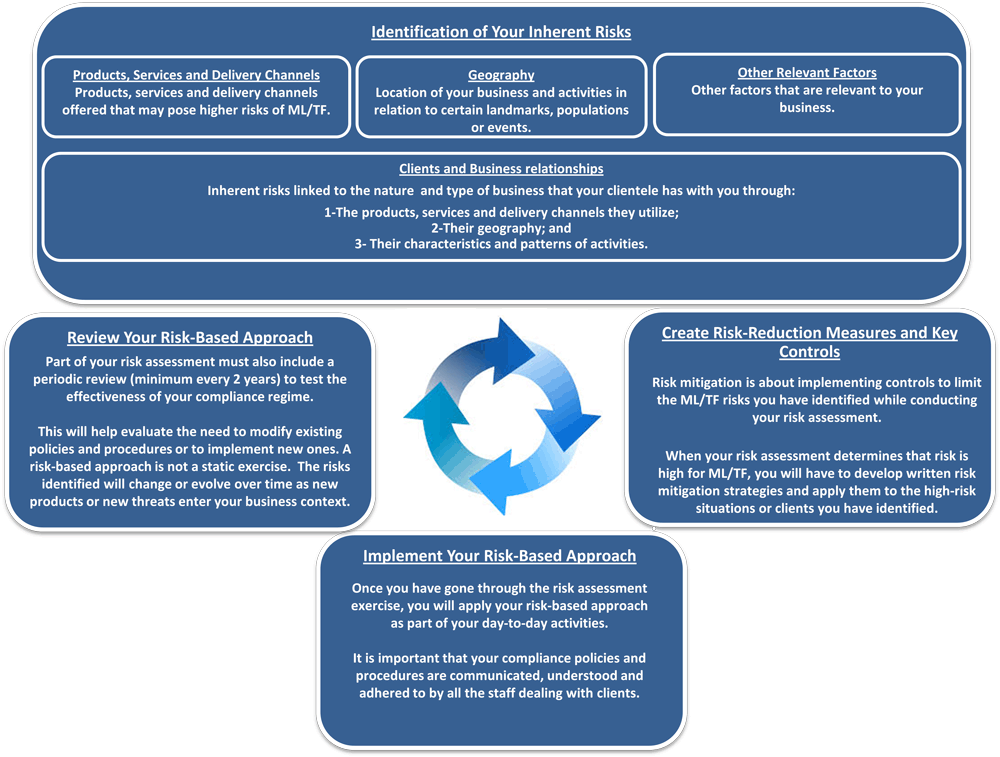

The risk-based approach RBA is central to the effective implementation of the FATF Recommendations. It means that competent authorities supervisors and legal professionals should identify assess and understand the money laundering and terrorist financing MLTF risks to which are exposed and legal professionalsimplement. Risk-based capital requirement refers to a rule that establishes minimum regulatory capital for financial institutions.

Risk-based capital requirements exist to protect financial firms their. Laundering and terrorist financing. Whereas the risk-based approach has been as well recommended and guided by regulatory bodies such as European Union EU directives Financial Conduct Authority FCA Dubai Financial Services Authority DFSA and others.

According to FATF guidance published on October 2014 RBA to AMLCFT means that. If a banking organizations risk assessment indicates potential for a heightened risk of money laundering or terrorist financing it will be expected to conduct further due diligence in a manner commensurate with the heightened risk. This is no different from requirements applicable to any other business customer and does not mean that a banking organization cannot maintain the account.

Risk financing is the determination of how an organization will pay for loss events in the most effective and least costly way possible. Risk financing involves the identification of risks. Son profil de risque Approche par le risque Risk based approach Consultations des listes NU et EU Vigilance constante à légard des opérations de la clientèle notamment compte tenu de la qualité des personnes impliquées voir listes NU et EU Alertes CTIF.

Déclaration de soupçons Déclaration dopérations suspectes ou de faits Déclarations de soupçon avant l. Risk typology The risk described here below may occur simultaneously andor cumulatively and have unpredictable effects on the investment value. Counterparty or credit risk Counterparty risk or credit risk is the risk that the borrowing issuer will not be able to meet its financial commitments.

The weaker the financial and economic situation of a financial instrument. Money Laundering and Combating the Financing of Terrorism and Illegal Organisations. Brief on the National Risk Assessment NRA in the United Arab Emirates Government of the UAE May 2018 italics added.

See for example Professional Money Laundering op. Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations Guidelines for. In simple words Financial Risks is the risk of losing money or losing valuable assets or having valuable asset but losing its value to full or some extent.

We can say that Financial Services or Transactions contain inherent or unavoidable risk. In broader terms the Financial Risk can be associated with a range of scenarios such as Financial Markets Business Administration Unforced. The latest KPMG Global Anti-Money Laundering Survey 2014 acknowledges that money laundering continues to be significant and posed increasing risks to the financial sector in particular KPMG 2014.

These facts are visibly attested that money laundering is a real problem to the financial sector and its risk shall not be underestimated. As banking institutions are the most vulnerable being. Additionally financial institutions must report transaction on a Suspicious Activity Report SAR that they deem suspicious defined as a knowing or suspecting that the funds come from illegal activity or disguise funds from illegal activity that it is structured to evade BSA requirements or appears to serve no known business or apparent lawful purpose.

Or that the institution is being used to facilitate criminal. Part of the samples should be selected according to a risk-based approach. Si le registre des armes à feu permettait de sauver des vies je ne crois pas quil y a un seul agent de police ou un seul député qui ne dirait pas que cest très bien quil nous faut un tel registre mais il faut avouer que cest lutilisation illégale des armes.

Accurate risk assessment is central to the risk-based approach there are two distinct categories of risk that inform financial institutions compliance efforts. The first is the idea of geographic risk. The vulnerability to money laundering threats that countries face at a national level.

The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk. Business partner is part of an illegal activity. Finance additional criminal activity which Reporting Suspicious Activities CTPAT Members may report suspicious activity related to TBML and terrorism financing by.

Contacting your local ICE office wwwicegovcontactfield-offices E-mailing ICE at ReportTBMLicedhsgov. The illegal wildlife trade is a major transnational organised crime which generates billions of criminal proceeds each year. Find out more in the FATF Report.

The impact on COVID-19 on the detection of money laundering and terrorist financing. Find out more about the FATFs focus on COVID-19 More webinars from the FATF. What is risk.