Everything else is the same. How to calculate volatility standard deviation on stock prices in PythonIn this video we learn the fundamentals of calculating volatility or standard devi.

Currently I am confused about the calculation of realised daily volatility.

How to calculate realized volatility. The formula of Realized volatility is the square root of realized variance. Variance in daily returns of the underlying is calculated as follows. R t logP t - log P t-1.

For example the annualized realized volatility of an equity index may be 020. Often traders would quote this number as 20. RealVol would disseminate the index value as 2000.

RealVol Daily Formula Formula 1. Vol Realized volatility 252 a constant representing the approximate number of trading days in a year. In order to calculate it you first need to calculate the log returns of the security as shown in the formula below.

In a next step the realized volatility is calculated by taking the sum over the past N squared return. The realized volatility is simply the square root of the realized variance. Analysts and traders can calculate the historical volatility of a stock using the Microsoft Excel spreadsheet tool.

Historical volatility is a measure of past performance. It is a statistical. The variance of is now easily derived using the calculated expected value and the variance formula.

With for all as the historical probability for each realization equals as written above thus. Using this we can calculate the standard deviation of the random variable or equivalentely the volatility. The spreadsheet that accompanies this presentation is not publicly available.

To get it you must purchase the potm video series where it is available in the. Calculate the average of the data set. Subtract the average from the actual observation to arrive the deviation.

Square up all the deviations and add them up to arrive the Variance. Calculate the square root of the variance to arrive the Standard Deviation. We can then pass symbols to this function using sapply and convert it to dataframe using stack.

Assuming the column where symbols are stored in the csv is called symbol. SP_500. The formula for the volatility of a particular stock can be derived by using the following steps.

Firstly gather daily stock price and then determine the mean of the stock price. Let us assume the daily stock. Next compute the difference between each days stock price and the.

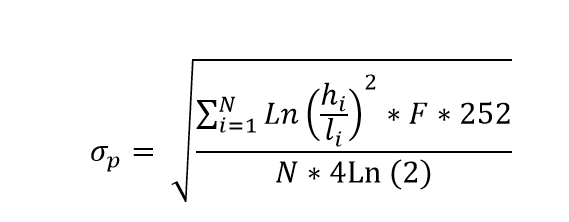

Parkinson calcparkinson The Parkinson formula for estimating the historical volatility of an underlying based on high and low prices. Sigma sqrt frac N 4 n times log 2 sum_ i1 n left log frac H_i L_iright2. For historical volatility calculation we will use sample standard deviation and the Excel formula for that is STDEVS if you are using Excel 2007 or older the formula is STDEV without the S.

Everything else is the same. Historical Volatility Calculation Step 1. Personally I mostly use 1 day day-to-day returns 21 or 63 days representing 1.

The actual calculation starts with calculating the continuously compounded. In this article we will look at how volatility is calculated using EWMA. So lets get started.

Calculate log returns of the price series. If we are looking at the stock prices we can calculate the daily lognormal returns using the formula lnP i P i-1 where P represents each days closing stock price. Currently I am confused about the calculation of realised daily volatility.

Assume I have daily returns for example FTSE then I need to estimate the daily realised volatility. This video shows how to calculate volatility using historical returns. A comprehensive example is presented that calculates the volatility of the SP 500 o.

How to calculate volatility standard deviation on stock prices in PythonIn this video we learn the fundamentals of calculating volatility or standard devi. The percentage change in closing price is calculated by subtracting the prior days price from the current price and then dividing by the prior days price. With this information we can now.

How to Find the Historical Volatility Standard Deviation of an Asset. If playback doesnt begin shortly try restarting your device.