An increase in paper money reduces the value of the US. The Federal Reserve increases the money supply by buying government-backed securities which effectively puts more money into banking institutions.

Youd say thats a 33 inflation.

How can money supply be increased. Money supply can rise if Central Banks print more money. Banks choose to hold a lower liquidity ratio. This means banks will be willing to lend a larger proportion of their funds.

How Central Banks Can Increase or Decrease Money Supply Modifying Reserve Requirements. The Fed can influence the money supply by modifying reserve requirements which. Changing Short-Term Interest Rates.

The Fed can also alter the money supply by changing short-term interest rates. How to increase the money supply Print more money Quantitative easing the electronic creation of money by Central Banks. Increased bank lending banks lending higher of their deposits.

Central Bank purchasing bonds from private individuals which can be spent. The money supply can be increased in an economy by purchasing government securities such as treasury bills and government bonds. The reverse happens when the central bank tightens the money supply by selling securities on the open market.

This Demonstration shows the implications for the economy if the money supply is increased. It uses the four key graphs taught in AP Macroeconomics. Initially this change decreases interest rates as seen on the money market graph.

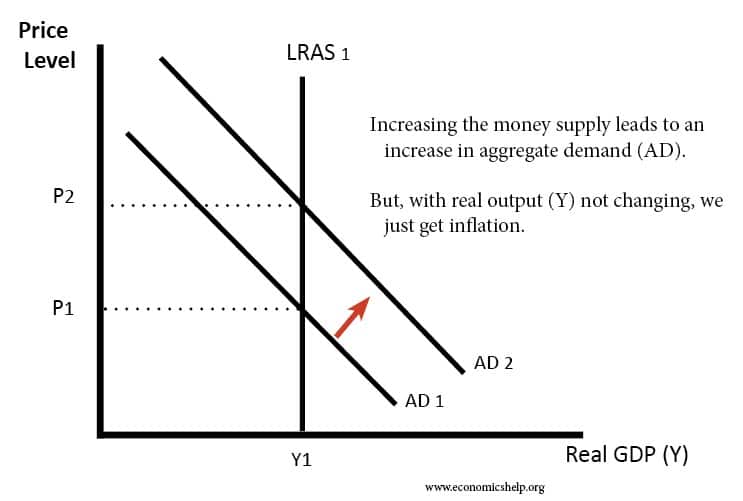

This increases the quantity of investment shown on the investment demand graph which increases aggregate demand. Money Supplys Intersection With Inflation. Expansion of the money supply can cause inflation but not always.

For example in April 2008 M1 was 1371 trillion and M2 was 7631 trillion both seasonally adjusted. The Federal Reserve doubled the money supply to end the 2008 financial crisis. It also added 4 trillion in credit to banks to keep interest rates down.

If the Fed wants to increase the money supply to the economy it buys bonds. For example if you sell the government a treasury bond you previously purchased you receive money in return. This money is now available to you for use so therefore when the Fed buys bonds its increasing the money supply.

According to many theories of macroeconomics an increase in the supply of money should lower interest rates in the economy. An increase in the money supply means that more money is. Central banks use several methods called monetary policy to developing or decrease the amount of money in the economy.

The Fed can increase the money supply by lowering the reserve requirements for banks which deducts them to lend more money. An increase in the money supply in a country. Refers to any policy initiative by a countrys central bank to raise or expand its money supply.

This can be accomplished with open market purchases of government bonds with a decrease in the reserve requirement or. An increase in money supply that results from it comes from the banking system which creates new money on the basis of its newly acquired excess reserves. Thus this concept tells us that the monetary authorities can control the money supply through changing the high-powered money or the money multiplier.

A 33 increase in M1 the most liquid portions of the money supply in the last 12 months. A 105 increase if you annualize it in the last three months to May. Youd say thats a 33 inflation.

Second I used this formula - Change in Money Supply Change in Reserves Money Multiplier - to calculate the maximum change in the money. The Federal Reserve increases the money supply by buying government-backed securities which effectively puts more money into banking institutions. An increase in paper money reduces the value of the US.

Dollar but increases the money banks can lend to consumers. If there is 1000 in a bank and I borrow that 1000 the money supply has increased by 1000. The original 1000 is still in the bank and whoever it belonged to can still come and get it.

For instance if the government wants to increase the money supply it will then buy back these instruments through the same process as mentioned in step 3 where the general public will be receiving plenty of money in return. This will result in the increase in the money supply. On the other hand if the government decides to decrease the.

For a given level of expenditures reducing the quantity of money demanded requires more frequent transfers between nonmoney and money deposits. As the cost of such transfers rises some consumers will choose to make fewer of them. They will therefore increase the quantity of money they demand.