No probability statistics could ever explain the consistency and superiority of their records. The efficient market hypothesis EMH maintains that all stocks are perfectly priced according to their inherent investment properties the knowledge of which all market participants possess.

The efficient market hypothesis EMH maintains that all stocks are perfectly priced according to their inherent investment properties the knowledge of which all market participants possess.

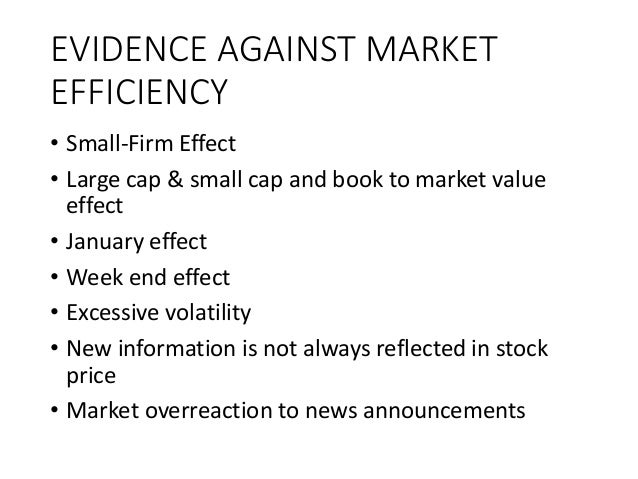

Evidence of market efficiency. 3 One of the enduring pieces of evidence against market efficiency lies in the performance records posted by many of the investors who learnt their lessons from Ben Graham in the fifties. No probability statistics could ever explain the consistency and superiority of their records. Some Anomalous Evidence Regarding Market Efficiency Michael C.

Jensen Harvard Business School MJensenhbsedu Abstract The efficient market hypothesis has been widely tested and with few exceptions found consistent with the data in a wide variety of markets. The New York and American Stock Exchanges the. Evidence in favor of market efficiency has examined the performance of investment analysts and mutual funds whether stock prices reflect publicly available information the random-walk behavior of stock prices and the success of technical analysis.

Empirical Evidence for the Efficient Market Hypothesis. 1008922 Outline various versions of Efficient Market Hypotheses. Discuss whether there is sufficient empirical support for each of these hypotheses.

The efficiency of financial markets has long been a contentious issue and as financial markets have evolved both in their breadth and complexity the question whether financial. We find that market efficiency is impaired after exogenous reductions of sell-side analysts suggesting that sell-side analysts contribute to price discovery. Our paper is also related to Wu 2017 who examines the behavior of corporate insiders after closures and mergers of brokerage firms.

Unlike sophisticated investors corporate insiders have access to private information at no cost. The efficient market hypothesis EMH maintains that all stocks are perfectly priced according to their inherent investment properties the knowledge of which all market participants possess. The concept of an efficient financial market in literature known as efficient market hypothesis EMH has had a long and difficult development path from the idea itself to.

In my view the most compelling evidence that our stock markets are extremely efficient is that they are extraordinarily hard to beat. If market prices were generally determined by irrational investors and if it were easy to identify predictable patterns in security returns or exploitable anomalies in security prices then professional investment managers should be able to beat the market. Its total market capitalisation at Januarys close was 212 billion which is less than 1 of the market cap of Apple Inc for the moment the largest stock in the SP 500.

If GameStop were a member of the SP 500 its end-of-January ranking would have been 297. Market efficiency concerns the extent to which market prices incorporate available information. If market prices do not fully incorporate information then opportunities may exist to make a profit from the gathering and processing of information.

The theory states that the market is weakly efficient because it doesnt allow Jenny to earn an excess return by selecting the stock based on historical earnings data. Financial market liberalization and stock market efficiency. Evidence from the.

Global Finance Journal 1 5 2 103-123. If the market is strong form efficient inside information is useless too because prices reflect all information. Securities prices tend to track each other closely over time and in fact usually display random walk behavior moving up and down unpredictably.

The Efficient Market Hypothesis EMH essentially says that all known information about investment securities such as stocks is already factored into the prices of those securities 1. Therefore assuming this is true no amount of analysis can give an investor an edge over other investors collectively known as the market. Further empirical work has highlighted the impact transaction costs have on the concept of market efficiency with much evidence suggesting that any anomalies pertaining to market inefficiencies are the result of a cost benefit analysis made by those willing to incur the cost of acquiring the valuable information in order to trade on it.

Market efficiency describes the extent to which available information is quickly reflected in the market price. In other words an efficient market is one in which the price of every stock or security incorporates all the available information and hence the price is the true investment value.