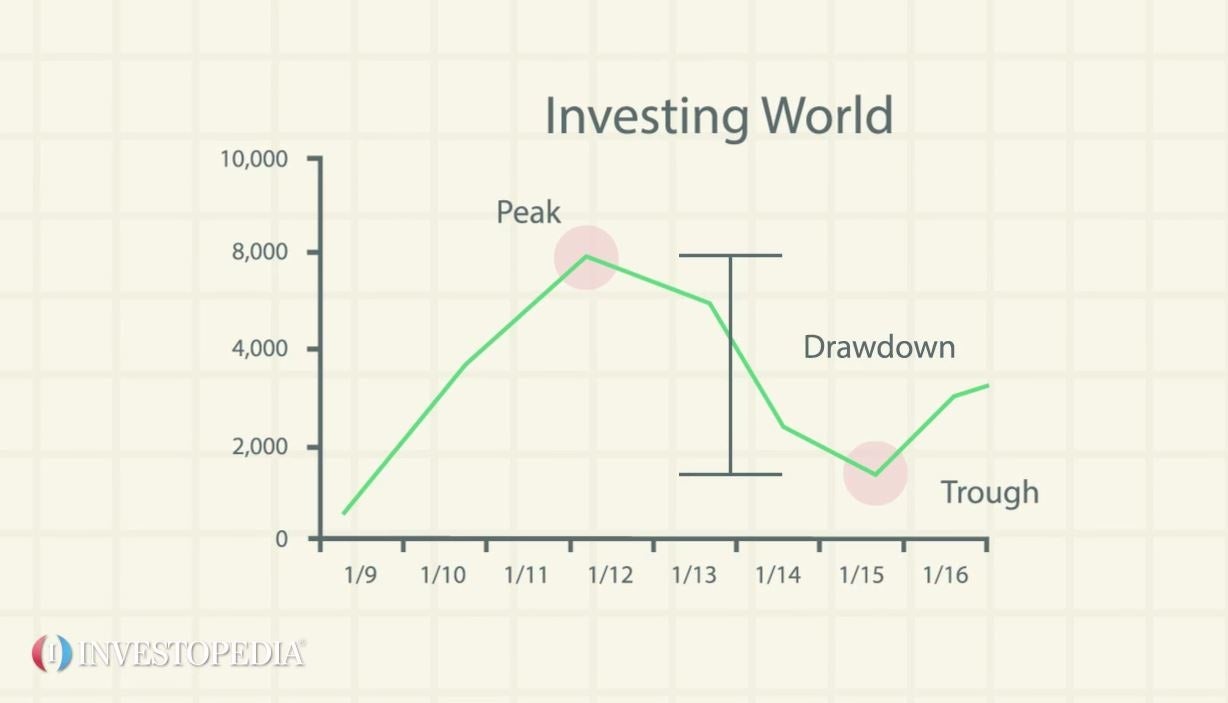

Drawdown definition in forex refers to reducing equity how much an investment or trading account is down from the peak before it recovers to the height. Providing your lender shares the credit agreement with the Credit Reference Agencies then you can expect your account to appear on your Credit Report showing the current balance account status.

Drawdown magnitude refers to the amount of money or equity that a trader loses during the drawdown period.

Drawdown meaning in banking. Drawdowns are often associated with retirement accounts and bank loans. Both terms have multiple meanings in the financial industry. In many ways a drawdown.

Key Takeaways In banking a drawdown refers to a gradual accessing of credit funds. In trading a drawdown refers to a reduction in equity. Drawdown magnitude refers to the amount of money or equity that a trader loses during the drawdown period.

A drawdown is a peak-to-trough decline during a specific period for an investment fund or trading account. Drawdowns help assess risk compare investments and are used to monitor trading. KEY TAKEAWAYS In banking a drawdown refers to a gradual accessing of credit funds.

In trading a drawdown refers to a reduction in equity. Drawdown magnitude refers to the amount of money or equity that a trader loses during the drawdown period. Within the context of banking a drawdown commonly refers to the gradual accessing of part or all of a line of credit.

If youre not planning on doing all of the work at once it is to the borrowers advantage to only draw down funds as needed from the line of credit that the bank extends to you. Key Takeaways In banking a drawdown refers to a gradual accessing of credit funds. In trading a drawdown refers to a reduction in equity.

Drawdown magnitude refers to the amount of money or equity that a trader loses during the drawdown period. In finance the drawdown is a concept related to loan facilities that allow the borrower to obtain funds from a credit line during the loan period. A drawdown refers to each of the amounts the borrower accesses from the loan facility.

A situation in which someone takes an amount of money that has been made available. The drawdown is when the lender processes the money and deposits it in the borrowers bank account. The borrower pays off the loan amount in increments usually with interest until the drawdown amount and other term agreements are satisfied.

The drawdown is when the lender processes the money and deposits it in the borrowers bank account. The borrower pays off the loan amount in increments usually with interest until the drawdown amount and other term agreements are satisfied. This process does not require another application for the borrower to fill out before receiving th.

Drawdown in banking refers to a gradual accessing of credit funds. Drawdown definition in forex refers to reducing equity how much an investment or trading account is down from the peak before it recovers to the height. Drawdown and loss are not the same things.

Plus simplement le drawdown mesure la perte et donc le risque dune stratégie de trading. Le drawdown maximal sur une période donnée correspond à la perte maximale enregistrée par une stratégie de trading sur cette période. Le drawdown peut être calculé sous forme de.

A Drawdown Loan sometimes known as a Drawdown Facility is a loan which enables you to take out Further Advances with very little formality. Will a Drawdown Loan appear on my Credit Report. Providing your lender shares the credit agreement with the Credit Reference Agencies then you can expect your account to appear on your Credit Report showing the current balance account status.

Drawdown is one of the most important and widely used mathematical technologies used by the analyst to analyze the performance of the stock or the fund or the fund based upon drawdown. Investors will always prefer investing in a stock or the fund will lower drawdowns history in the past as it directly hits the performance of the fund managers. Drawdown in Banking vs.

An Overview The term drawdown appears in both. In this article Drawdown in Banking vs. We will discuss.

Drawdown in Banking vs. An Overview The term drawdown appears in both the banking world and the trading world but it has very different meanings within each context. In banking a drawdown refers to a gradual.

In construction a situation in which a company receives part of the funding necessary to complete a project. The company may receive the funding gradually over the course of the project. The key difference between drawdowns in banks is the borrowers gradual access to credit funds.

It should be noted that such a finance distribution can be divided into certain stages and issued as needed. When it comes to a loan drawdown in banks affects both individuals and companies alike.