Some of the differences between factor income and transfer income are as follows. NFFI is the difference between the aggregate amount that a countrys citizens and companies earn abroad and the aggregate amount that foreign citizens and overseas companies earn in that country.

Each factor of production when we put it into use provides us with an income ie a factor income.

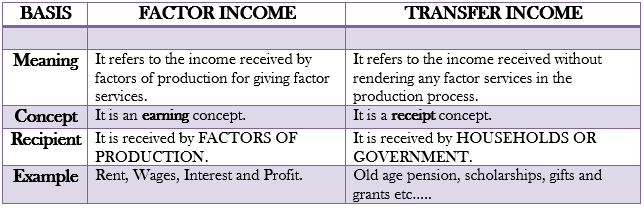

Difference between factor income and transfer income. 5 Zeilen Factor Income refers to an income that can be derived by selling inputs or means of. Some of the differences between factor income and transfer income are as follows. The difference between the two is whether or not the income payment received is for rendering productive service.

Payment received in exchange for rendering productive service is factor income whereas the one received without providing any service or good in return is transfer income. Factor Income and Transfer Income Differences Meaning. Factor income refers to that income which is received by an individual for doing service or providing good to.

Wages or salary earned by workers rent earned by the landlord profit earned by. Some of the differences between factor income and transfer income are as followsThe difference between the two is whether or not the income payment received is for rendering productive servicePayment received in exchange for rendering productive service is factor income whereas the one received without providing any service or good in return is transfer income. These are incomes received by the owners of factors of production for rendering their factor services to the producers.

These are all those unilateral payments meaning these incomes are not received for buying and selling of goods and services. What is the difference between factor income and transfer income. Ask questions doubts problems and we will help you.

Different between factor income and transfer income Get the answers you need now. Parry3329 parry3329 21072019 Economy Secondary School answered Different between factor income and transfer income 1 See answer parry3329 is waiting for your help. Factor income on the use of land is called rent income generated from labor is called wages and income generated from capital is called profit.

The factor income of all normal residents of a. Transfer income is a receipt concept as compared to factor income which is an earning concept. We have already discussed in the preceding pages that income arises from production of goods and services.

Explain two differences between factor income and transfer income. Difference between Net factor income from abroad and net exports. Ask questions doubts problems and we will help you.

Income method measures the incomes received by different factors of production Land Labour Capital Entrepreneurs. It is different by its source from the other two methods and thus helps to make the calculations of the national product more accurate by giving it a different source. It is easy to calculate again from the income tax receipts.

What is the difference between expense money transfer and income. An Expense is the most common transaction in Tricount. It represents an amount that is spent by a participant for the group or a subset of the group.

The difference between GNP and GDP is usually small because the income generated by citizens abroad and by foreigners at home often compensates for each other. Significant differences in income factors are more likely to be found in small developing countries where most of the income can be generated by foreign direct investment FDI. Factors of production are the inputs we use to produce things so that we can make a profit.

Economists divide the factors of production into four different categories. Land Labor Capital and Enterprise. Each factor of production when we put it into use provides us with an income ie a factor income.

NFFI is the difference between the aggregate amount that a countrys citizens and companies earn abroad and the aggregate amount that foreign citizens and overseas companies earn in that country.