For example in May 2005 the average bond fund benchmarked against the Lehman Aggregate Bond Index had an expense ratio of 11 while the indexs YTM was only 46. For example a duration of 40 means a 1 interest rate rise causes about a 4 drop in the fund.

For example a duration of 40 means a 1 interest rate rise causes about a 4 drop in the fund.

Bond fund performance 2015. If the past few months provide any clues for the 2015 bond market VBMFX is looking like a winner. For the past three months performance for the Total Bond Market Index ranks ahead of. As of December 31 2015 Morningstar rates the Funds Institutional share class 4 stars overall out of 301 funds.

It has 18 billion in assets across three share classes CRAIXCRANXCRATX. For example inflation-protected bond funds have gained an average 255 in 2015 even though the consumer price index the governments main inflation indicator fell 06 in December. In the end index funds outperformed.

They were flat for 2015 while active funds fell 18 on average according to Morningstar. Fewer than a quarter of. The Funds net asset value was 13 billion as of June 30 2015.

As of June 30 2015 the current yields were 05 for Series C units 05 for Advisor Series units 04 for Series D units 05 for Series F. Morningstar Return Rating. 5-Year Average Return 213.

Number of Years Up 30. Number of Years Down 4. Best 1 Yr Total Return Feb 3.

Annual Total Return History. This paper studies the performance of US. Taxable bond mutual funds employing a novel data set of portfolio weights.

Active fund managers exhibit outperformance before costs and fees generating on average gross returns of 1 per annum over the benchmark portfolio constructed using past holdings approximately the same magnitude as expenses and transaction costs combined. The performance measure based on portfolio holdings appears to predict future fund performance. SP 500 Index Fund.

Bond Fund Index Fund. Loomis Sayles Investment Grade Bond Fund Class A The maximum sales charge on purchases of Class A shares was reduced from 450 to 425 on November 2 2015. The Funds returns for Class A shares have been restated to reflect the current maximum applicable sales charge of 425.

The consistency test ensures that the funds superior results are not attributed to a lucky streak. To pass the test each fund must have out-performed its peers at least 50 of the time. Effective 1012015 the A Class maximum front-end sales charge was changed from 475 to 300 for Floating Rate Strategies and to 400 for High Yield Investment Grade Bond Macro Opportunities Municipal Income and Total Return Bond.

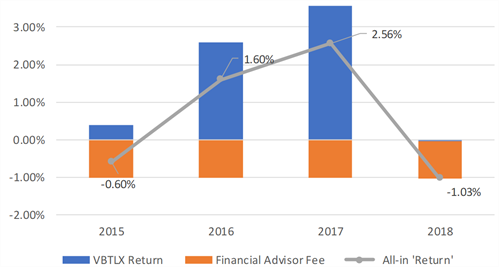

For performance periods that begin prior to 1012015 a 475 load was used and for performance periods that begin after 1012015 a 400 load was. While the above analysis gives you a feel for the absolute return of a bond fund costs will have a big impact on its relative performance particularly in a low interest rate environment. For example in May 2005 the average bond fund benchmarked against the Lehman Aggregate Bond Index had an expense ratio of 11 while the indexs YTM was only 46.

The higher the duration the more sensitive the fund. For example a duration of 40 means a 1 interest rate rise causes about a 4 drop in the fund. Duration is considerably more complex than.

BCP Capital Secure Bonds - Performance Summary End Q2 2015. BCP Capital Secure Bonds - Performance Summary End Q1 2015. BCP Capital Secure GBP Sterling Bonds - Performance Summary End Q2 2015.

BCP Capital Secure GBP Sterling Bonds - Performance Summary to 16032015. BCP Capital Secure GBP Sterling Bonds - Performance Summary to 31012015. February 3 2015 The Premier Philam Bond Fund the Fund is a PHP denominated single asset fund created for peso variable life insurance contracts issued by BPI-Philam Life Assurance BPLAC Corporation.

The Fund is fully invested in Philam Asset Management Incs PAMI Bond Fund PBF. The PBF is an open-end mutual fund with a. Breakdown of instruments into Bond Balanced and Equity profile on the basis of the individual delta level being above or below the 30 and 70 thresholds.

07 333 144 Bond profile. Delta 30 Mixed profile. Delta 70 0 10 20 30 40 Portfolio Index Portfolio Breakdown by Maturity 106 212 494 189.

Trouvez les Spectre Ctbf Royal Film Performance 2015 Vip Arrivals images et les photos dactualités parfaites sur Getty Images. Choisissez parmi des contenus premium Spectre Ctbf Royal Film Performance 2015 Vip Arrivals de la plus haute qualité. Expenditures in the fund for the year ended June 30 2015.

A total of 43485 was spent out of the fund during the year. We tested 11 separate expenditures totaling 31860 or 7327. All items sampled were found to be in compliance with 2003 Measure A intended use of bond proceeds.