Weekly 1997-02-07 to 2007-01-05 2007-01-08 10-Year 0-58 Treasury Inflation-Indexed Note Due 7152021. Percent Daily Not Seasonally Adjusted 2011-07-22 to 2021-05-11 14 hours ago 10-Year 025 Treasury Inflation-Indexed Note Due 7152029.

Percent Daily Not Seasonally Adjusted 2011-07-22 to 2021-05-11 14 hours ago 10-Year 025 Treasury Inflation-Indexed Note Due 7152029.

10 year treasury total return. So if you buy and sell the same month itll be 0. Annualized 10 Year Treasury Return - The total price return of 10 Year Treasuries as above annualized. This number basically gives your return per year if your time period was compressed or expanded to a 12 month timeframe.

26 rader NYSE US 10 Year Treasury Futures Index Total Return Level. 52 rader The 10-year Treasury Portfolio is exposed for 0 on the Stock Market. Historically the 10 Year treasury rate reached 1584 in 1981 as the Fed raised benchmark rates in an effort to contain inflation.

10 Year Treasury Rate is at 169 compared to 164 the previous market day and 069 last year. 10-Year Bond is a debt obligation note by The United States Treasury that has the eventual maturity of 10 years. The yield on a Treasury bill represents the return an investor will.

61 rader The 10 year treasury is the benchmark used to decide mortgage rates across the US. Without access to Barclays or Merrill Bond Indicies to the 1970s or Ned Davis to 1950 studying historical bond returns is very difficult. Here is a way to derive price and total returns on the 10 year US Treasury back to 1962.

I would like to extend to 1871 but monthly yields from Shiller and Fed are averages of the daily yields and not month-end. Assume you have the time series of 10-year Treasury constant-maturity yield y_t from FRED you can calculate the total return R_t from t to tDelta t as following. Delta t 1365 textMonthly.

Delta t 112 textYield change. Delta y y_tDelta t - y_t textMaturity. M 10.

The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. As of Feb 28 2015 the Funds total assets were 9067170149 and the Funds investment portfolio was valued at 9041290544. The YTD Return 7-10 Year Treasury is.

666 161437 15418 23953 47033 -255-1130-633. 510 204440 15781 24446 49432. 1 Yr Return.

Treasury Bond Current 10-Year Index. 1 Yr Return -707. The index Launch Date is Sep 13 2013.

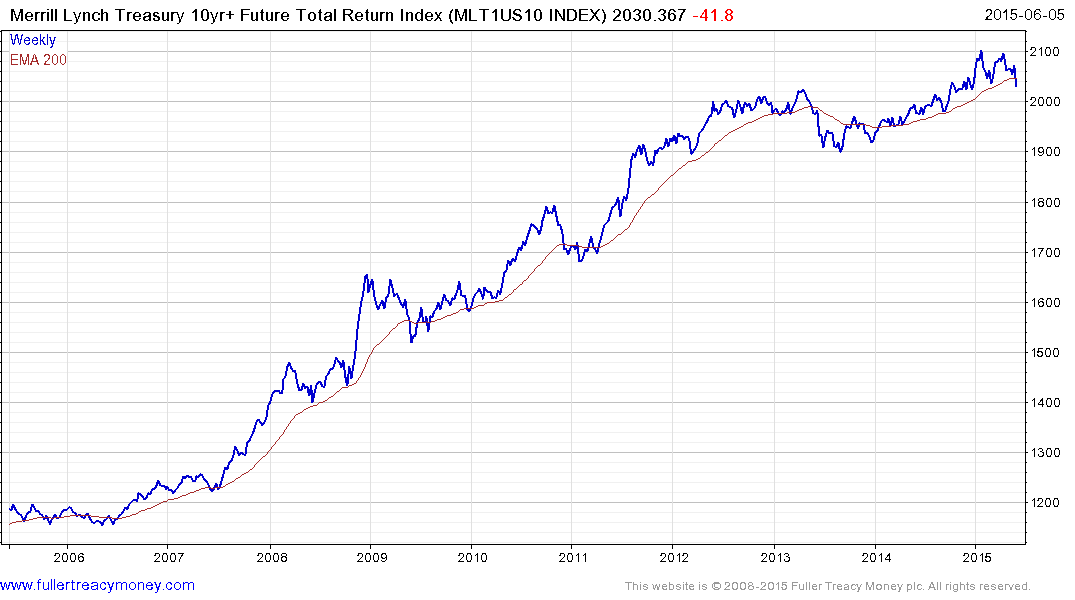

All information for an index prior to its Launch Date is hypothetical back-tested not actual performance based on the index methodology in effect on the Launch Date. The Merrill Lynch 10-year US. Treasury Futures Total Return Index measures the performance of a fully collateralized rolling 10-year US.

SP 10-Year US. Treasury Note Futures Index. 32160 USD -012 1 Day.

Overview Data Index-Linked Products News Research. As of May 11 2021. Index performance for Bloomberg Barclays US.

Treasury 5-10 Yr Total Return Index Value Unh LT51TRUU including value chart profile other market data. 10-year Treasury note is the benchmark for US. Interest rates as it is the most liquid heavily-traded debt security issued by the federal government.

Just like stock investors turn to the Dow Jones Industrial Average or the SP 500 Index to gauge how the US. Stock market is performing bond investors watch the rise and fall of the 10-year Treasury note to interpret how the interest rate market. The annual total return for an investor in the 10-year Treasury bond.

Methods We use the daily 10-year Treasury constant maturity rate 3 as our time-series of yield-to-maturity. Since this rate corresponds to a 10-year bond the remaining maturity is constant. M t 10.

Weekly 1997-02-07 to 2007-01-05 2007-01-08 10-Year 0-58 Treasury Inflation-Indexed Note Due 7152021. Percent Daily Not Seasonally Adjusted 2011-07-22 to 2021-05-11 14 hours ago 10-Year 025 Treasury Inflation-Indexed Note Due 7152029. Ryan Labs 10 year US.

Treasury Total Return Index monthly from 1978 and return charts for 1 year 2 years 3 years 5 years and 10 years.